U.S. distributors recorded a record year in 2021 for revenues while protecting margins — in spite of continued pandemic and supply chain pressures in the back half of 2021. And the outlook for 2022 is positive as economic and market indicators point to “new-normal” disruptors stabilizing. Those are a few of the takeaways from the MDM 2022 Annual Distribution Industry Outlook webcast (access on-demand here).

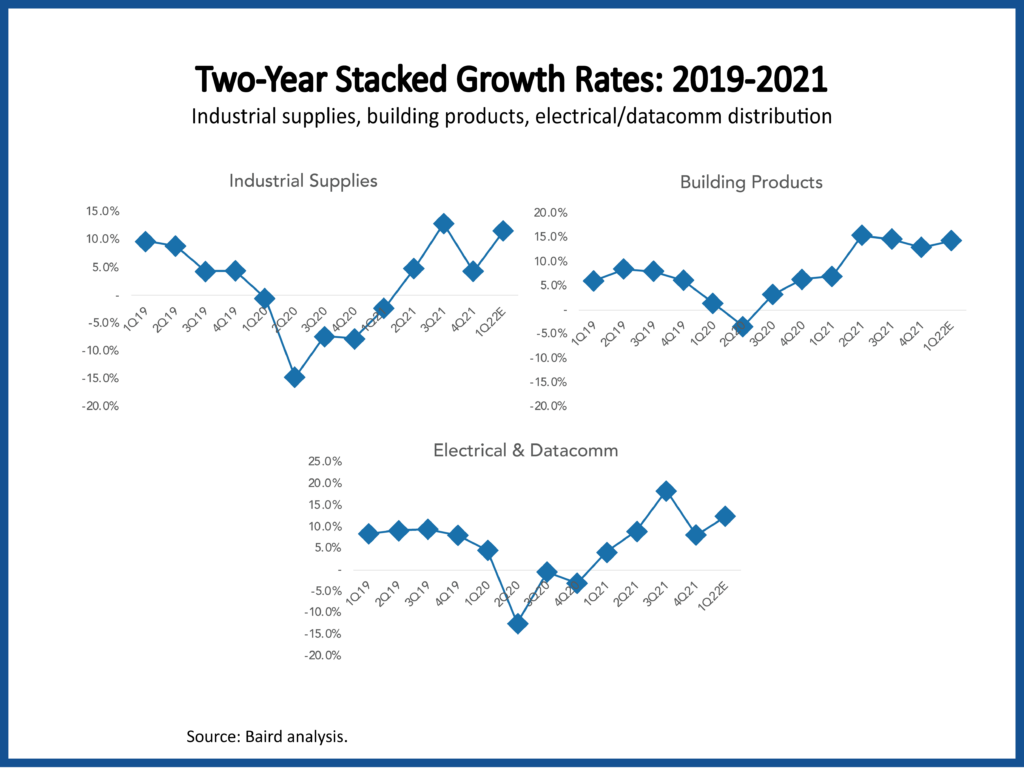

We are in an accelerating early-cycle economy, said David Manthey, senior research analyst for Baird. And while the hot pace of the construction and building materials sectors cools, industrial sectors are well positioned for growth and pricing in 2022 and beyond. Manthey presented an overview of key industry sector economic performance and indicators, as well as the fourth quarter 2021 results of the latest Baird-MDM industry survey.

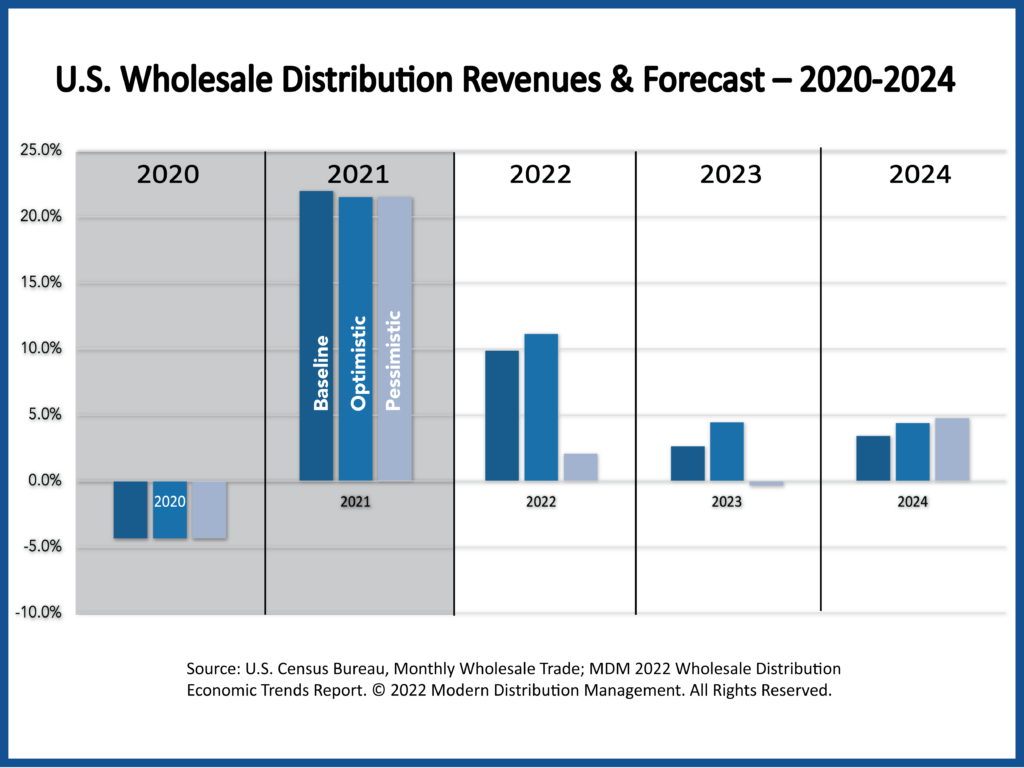

Total U.S. wholesale distribution sector revenues in 2021 increased 22% to roughly $7 trillion, according to analysis presented by MDM’s Tom Gale on how the 19 major sectors have performed through the pandemic and forecast revenues through 2024.

Cause for Optimism in Fourth Quarter Survey

Manthey noted there is cause for optimism, especially as respondents to the quarterly survey of more than 500 industrial, construction and building materials distribution executives have recently increased their growth forecast for 2022. “I’d say the punch line here is 90 days ago, the expectation for growth across the survey in 2022 was about 7%, but today, it’s 8%,” Manthey said. “So, I think the takeaway from this is that the 2022 forecast is a little bit better and a little bit more encouraging than it was just 90 days ago.” Responding to a question on the impact of pricing on positive growth rates, Manthey commented that, overall, they seemed relatively equal.

There is momentum for these beliefs, Manthey noted, especially when looking at responses to the survey about the 4th Quarter 2021. Industrial experienced +9% year-over-year growth last quarter, and Building Products grew by +10%.

“We finished the quarter up really strong,” one survey respondent wrote. “In December, our booked sales were better than November and equal to September/October which is unusually strong. But orders are not the problem. Supply chain and profitability are the problem.”

Indeed, supply chain crept into the Baird/MDM quarterly survey, as part of an open-ended question as to “what is going on in your world?” In the fourth quarter, 17% mentioned “supply chain constraints” as being a problem in their lives, up from 13% in the third quarter 2021.

“One of the respondents to our survey, a distributor of valves and fittings, told me his business is down 50%,” Manthey said. “He said that he’s reading about the supply houses, business is booming, and things are great. But it’s not for him, and I think the reason I mentioned that is in the case where there’s supply shortages, many of the large companies are getting better access to product than the small companies are, and we’ll see how long that continues, but let’s just say it’s still an issue in 2022. Hopefully, we start to get that resolved, but there’s no sign of that happening just yet.”

Pricing & Inflation Impacts

“Pricing is still positive; it may not be accelerating at the same rate and may be plateauing, but it’s still positive and net-net, even though the rate of change may be peaking out at a high level, we think 2022 will still be a year of positive price increases,” Manthey said. “Manufacturers importantly are saying they’re expecting to push through price increases in the back half of 2022. This could go on into 2023. I don’t think we’re seeing an end in sight here.”

Another key theme is strong demand and limited supply are supporting good pricing realization, while bolstering margins. Respondents to the survey had a great deal to say about this phenomenon affecting the U.S. as a whole:

- “Costs continued to rise but we were able to capture the margin with price increases.”

- “Manufacturer price increases are overwhelming. For the most part we are able to pass them through to customers. There is less customer price sensitivity on supply challenged items. Customers just need product.”

- “Due to current supply issues, many customers were anxious to get product on order. Pricing was a secondary consideration. Pricing and margins increased.”

- “Availability has prevailed over price.”

- “The market is positioned to be able to pass on appropriate price increases, customers are cognizant of the global constraints on supply and are more understanding that price increases must be accepted to maintain a more reliable supply chain.”

- “Revenue and prices outpaced cost increases. Those two together have led to improved margins.”

- “Due to supply limits and manufacturers raising prices, distribution has had zero inventory cushion and has had to pass increases through the supply chain immediately.”

For a deeper dive into the core market and economic factors shaping 2022 and beyond for distribution sectors for your specific product sector, watch the MDM 2022 Annual Distribution Industry Outlook webcast (access on-demand here).

MDM Premium members get access to the MDM MarketPulse quarterly report, which provides a comprehensive analysis of the monthly Baird-MDM industry survey, which compiles revenue, pricing and other performance trends across industrial, construction and building materials sectors based on the responses of more than 500 distribution executives representing more than $100 billion in revenues. Learn more about an MDM Premium subscription.

The post Momentum, Lingering Headwinds Mark 2022 Distribution Outlook appeared first on Modern Distribution Management.